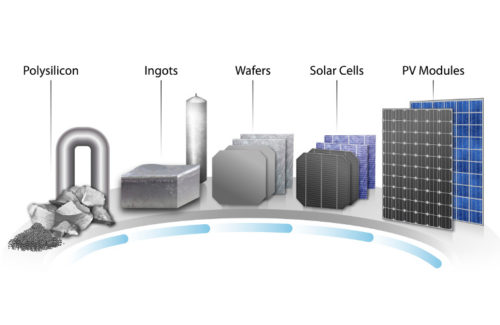

With manufacturing credits once again included in a congressional reconciliation bill, new solar development plans could be back on the table in the United States. The current draft of the Inflation Reduction Act (IRA) of 2022 includes $370 billion in energy and climate spending, with manufacturing credits as presented in the former Solar Energy Manufacturing for America (SEMA) Act still intact: solar-grade polysilicon ($3/kg), PV wafers ($12/m2), thin-film and silicon PV cells (4¢/WDC), thin-film and silicon PV modules (7¢/WDC).

The entire industry would be buoyed if credits are approved, but no companies more so than Hanwha and REC Silicon. Hanwha, which is increasing its Qcells solar panel campus by 1.4 GW even without guarantee of credits, is the largest shareholder in REC Silicon and previously stated the polysilicon factory in Moses Lake, Washington, which has been closed for years, will reopen by Q4 2023. Hanwha has pledged to secure North American manufacturing capabilities across the full solar supply chain — the company has signed a Canadian glass manufacturer for its Qcells modules and REC Silicon will get silicon metal supply from Ferroglobe plants in the United States.

What’s still missing, though, is domestic solar silicon ingots, wafers and cells. There are currently no North American suppliers of the important silicon product steps between raw material and the final solar panel — at least not yet.

Solar Power World spoke with Chuck Sutton, VP of FBR sales at REC Silicon, after finding permitting plans submitted to the Moses Lake City Council for an “ingot and wafer process” facility. Sutton could not comment on anything specific but did say solar manufacturing credits would determine the company’s future plans.

“We’re acquiring land around us and exploring opportunities. It’s a normal course of business,” he said.

In November 2021, before any official Hanwha involvement with the company, REC Silicon submitted “Project Riser” to the Moses Lake City Council. Project Riser detailed plans to rezone nearby land parcels from agricultural to industrial for the purpose of building an ingot and wafer production site. The new construction would be an expansion of REC Silicon but operated by a sister company. The city council approved the land use request of 162 acres in March 2022.

REC did own the land parcels before, but sold them for farming when the polysilicon market flipped in favor of cheaper Chinese production.

“We never thought we’d do anything more around here, so over time we ended up selling some land off,” Sutton said. “Now we see some other opportunities coming around, so we thought we should buy it back just to have it.”

When the SEMA Act was first announced in June 2021, Sutton said “probably half a dozen” different companies said they wanted to build an ingot plant in the area to use Washington’s plentiful hydropower electricity and be near REC’s polysilicon operations. Knowing how long land acquisition can take, REC decided to be proactive while SEMA credits were debated.

If the IRA is passed with solar manufacturing credits included, ingot and wafer processing could potentially start in Moses Lake. Washington State offers tax breaks to solar product manufacturers, and the governor has allocated $10 million for electrical infrastructure investment in REC’s area. REC stated in permitting documents that development of Project Riser could result in up to 2,500 jobs and $2 billion in construction costs.

Currently though, REC Silicon is focused on restarting the polysilicon manufacturing operations at the Moses Lake plant. New engineering jobs have been posted, and Sutton said the group will hire 150 people over the next several months to stay on track for Q4 2023 production. All of the site’s reactors have to be updated — the factory formerly produced multicrystalline silicon, and now the industry has moved to monocrystalline.

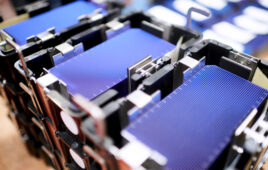

Wafers coming off the line at SolarWorld’s Oregon manufacturing facility. Archive photo from the Oregon Department of Transportation

“Everything is mono now and moving toward n-type, so higher purity is where you need to be,” Sutton said. “Over the next year, we’re going to upgrade all our reactors here in Moses Lake to handle that new process.”

REC Silicon is taking things one day at a time — but the future could hold bigger plans.

“Our largest shareholder (Hanwha) has publicly said they’re expanding in Georgia and wants to do stuff in the States. If we want to be in the mix, we have to have land available,” Sutton said. “We want to stay low-carbon, we want to do as much as we can in North America. Hopefully it continues to work out, and we’ll continue exploring all those opportunities here.”

November 3, 2022 update: Local county commissioners approved REC Silicon’s request to rezone the “Project Riser” area from agricultural to industrial.

I worked on the original construction of the Moses Lake plant 1983-1987 as a project engineer for the concrete subcontractor, then the office engineer supporting the project engineer of the prime contractor, Rust Engineering for the then-owner Union Carbide. My first project after graduating from college. I have followed the site over the years through articles like yours. Good to hear the plant is coming back. I read an article that their saline product will be used for batteries improvements. Could extend storage of lithium-ion batteries by 10-15%. Thanks.