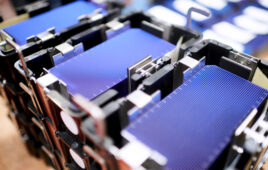

The end of 2019 saw the official first step down of the federal ITC, so it was really no surprise that the utility-scale solar pipeline hit a historic high of 37.9 GW — 11.2 GW of new utility projects were announced in H1 2019 alone. Huge proposed installation numbers are great, as long as the U.S. market has solar panels available to fill orders. Still in the middle of a four-year tariff fight, and with a number of other battles working their way through the courts, “affordable” solar panels may continue to be hard to come by in the United States.

First, the facts: Imported solar panels and cells are taxed under Section 201 of the Trade Act. First approved in 2018, the tariffs currently stand at 20% and will drop to 15% in 2021 before (fingers crossed) ending in 2022. The U.S. solar market was estimated to have installed 12.6 GW in 2019 and is expected to install more than 17 GW in 2020. Even with the 2019 additions of new solar panel manufacturing state-side (1,700 MW from Q CELLS, 400 MW from JinkoSolar, 500 MW from LG), there is no way U.S. manufacturing can meet the demand for multiple gigawatts of new solar panels. Tariffed solar panels will keep prices higher — panels sold in China average at $0.19/watt while panels in the United States fall between $0.35 and $0.43/watt (based on 2019 averages).

First, the facts: Imported solar panels and cells are taxed under Section 201 of the Trade Act. First approved in 2018, the tariffs currently stand at 20% and will drop to 15% in 2021 before (fingers crossed) ending in 2022. The U.S. solar market was estimated to have installed 12.6 GW in 2019 and is expected to install more than 17 GW in 2020. Even with the 2019 additions of new solar panel manufacturing state-side (1,700 MW from Q CELLS, 400 MW from JinkoSolar, 500 MW from LG), there is no way U.S. manufacturing can meet the demand for multiple gigawatts of new solar panels. Tariffed solar panels will keep prices higher — panels sold in China average at $0.19/watt while panels in the United States fall between $0.35 and $0.43/watt (based on 2019 averages).

Also interesting is the 2.5-GW cap on tariff-free solar cells entering the country for U.S. module assemblers. With new manufacturing setups, domestic manufacturers have met that 2.5-GW capacity, and any additional cells needed will be tariffed the same amount as full module imports. Many companies at the International Trade Commission’s midterm hearing on the solar tariffs requested increasing the amount of imported cells exempt from tariffs to 5 GW. If the trade rate quota (TRQ) is not increased, expect even American-assembled panels to increase in price.

The utility-scale market, which is the dominant solar installation market in the country, may see some relief with the reinstated tariff exemption on bifacial module imports. WoodMac has estimated that the United States will install 2 GW of bifacial projects in 2020 — with panels untaxed.

Unless the tariff is updated in the next month, expect continued taxes on imports to prolong the trend of inflated solar panel prices in the United States for at least the next two years.

Tell Us What You Think!