There have been some announcements of crystalline silicon solar panel manufacturing outfits coming to the United States in the last couple years, but so far, nothing new has opened since Q CELLS (Georgia), LG (Alabama) and JinkoSolar (Florida) unveiled their panel assembly facilities in 2019. In fact, this year saw the closure of one of the longest-running solar panel manufacturing facilities in the United States when SunPower ceased production at the former SolarWorld plant in Oregon after over a decade of on-site manufacturing and 40+ years of technical know-how.

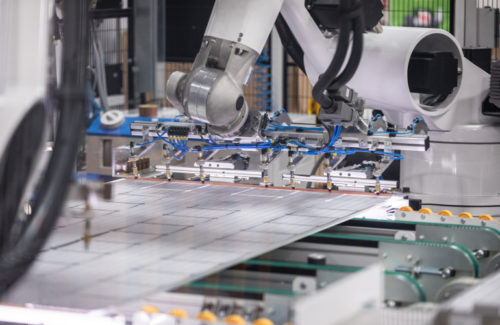

Archive photo of SolarWorld’s Oregon facility

But those veteran SolarWorld manufacturing lines live to fight another day now that ACO Investment Group (working through its subsidiary Convalt Energy) has bought the equipment and is moving it all to a new facility in upstate New York. The plan is to have 700 MW of American assembled solar panels coming out of the new-build factory starting in July 2022.

Solar Power World spoke to Hari Achuthan, managing director and CEO of Convalt Energy, to learn more about the company’s plans for U.S. solar manufacturing.

Who is Convalt Energy?

Convalt Energy initially began in 2011 as a solar developer, working on projects in Southeast Asia and Africa, but Achuthan said the focus is now on developing projects and starting panel manufacturing in the United States.

“We cut our teeth in development, and we’re now developing projects in the U.S.,” he said. “This opportunity came up [to buy SunPower equipment], and we’ve always had a vision of wanting to be a manufacturer in the U.S. to support American jobs and support the supply chain coming back to the U.S. This opportunity came up and our shareholders agreed we should do this.”

The Convalt website shows that a few members of the company’s technical team have experience with module manufacturing, but mostly Convalt will use its experience in buying modules for projects in multiple countries to be competitive in module manufacturing.

“During the last nine years, we have been developing projects and had to understand the supply chain, had to understand the pricing of panels,” Achuthan said. “We had exposure to pricing from a variety of sources, including SunPower and First Solar and panels from Chinese manufacturers. We started to dissect and understand how the pricing worked.”

Why New York?

Archive photo of SolarWorld’s 5-busbar stringer from 2016

The schedule of events is to break ground on the new facility in New York by October 2021, with module production beginning in July 2022. Convalt Energy expects an annual module capacity of 700 MW out of the gate.

Convalt chose Watertown, New York, near Lake Ontario, as its manufacturing base because the area has an eager manufacturing employment pool. Watertown has a long history of industrial success, once a major hub for pulp and paper mills, and access to clean energy from hydropower.

The Watertown facility is a go, and any manufacturing tax credits (like the one recently introduced to the Senate), incentives and grants would bolster the company’s startup and growth plans.

“We’re moving forward with this. [Any future federal credits] will give more comfort to the lenders as we need to expand and get additional working lines to move from 700 MW to 2 GW or getting cell lines or wafer lines,” Achuthan said.

What’s going to be made in the new factory?

Archive photo of SolarWorld’s Oregon facility

Convalt Energy acquired SunPower’s production lines in April 2021. The equipment, which was most recently producing SunPower’s shingled P-Series modules, has likely not been used since March 2021 when SunPower ceased operations at the plant. Since the equipment hasn’t been mothballed long, Achuthan expects startup to be quick with no major technology upgrades needed.

“I would say 95% will stay the same. There’s going to be some updates, but that’s minor,” he said.

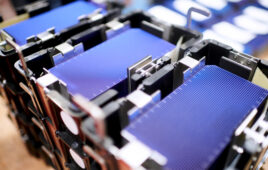

Achuthan said Convalt is using its own technology to manufacture 72-cell panels for rooftop and utility-scale projects. He expects that Convalt will move to “the next generation technology pretty fast, within the next two years.”

Convalt does plan to use some of its produced modules for its own developed projects, but third-party sales will likely increase as demand accelerates. Things will iron out as plans set into place. Right now, Achuthan and Convalt are focused on shipping the equipment lines to New York and setting up U.S. manufacturing jobs.

“Our commitment is on supporting American jobs and getting the supply chain back here to the U.S. so we have control,” Achuthan said.

Asking to speak with Michel Wiser, Chief Watertown Strategist. To develop hydropower on the Black River the current technology is with rolling drums from WATEROTER Energy out of Ottawa. These drums require a river depth of 4ft. There are places to develop this power in the City, Brownville, and Dexter.

I will show you. Then when you are done with sitar production you pick the drums from the river and take them with you.

Great news for Watertown ,New York!

P Series is a Shingled module, Solaria might have some concerns about this.

Many companies have shingled designs: https://www.solarpowerworldonline.com/2020/07/what-are-shingled-solar-modules/

“But those veteran SolarWorld manufacturing lines live to fight another day now that ACO Investment Group (working through its subsidiary Convalt Energy) has bought the equipment and is moving it all to a new facility in upstate New York. The plan is to have 700 MW of American assembled solar panels coming out of the new-build factory starting in July 2022.”

One ‘hopes’ this group Convalt Energy realizes making solar PV panels, with energy generated (with) solar PV panels is the correct way to go and starts off strong with their own solar PV roof and energy storage system to cut down on middleman energy costs along the manufacturing line from day one of the plant’s operations.

“Watertown has a long history of industrial success, once a major hub for pulp and paper mills, and access to clean energy from hydropower.”

This is interesting, one has some options with cheap hydro power available. You can put in a smaller solar PV array on the manufacturing building’s roof and spend more money on the Micro-grid to store, time shift energy to avoid demand charges and TOU rate spiking saving more on the electric bill each month above the solar PV generation available.